How do Fortune 500 Companies Avoid Federal Income Taxes

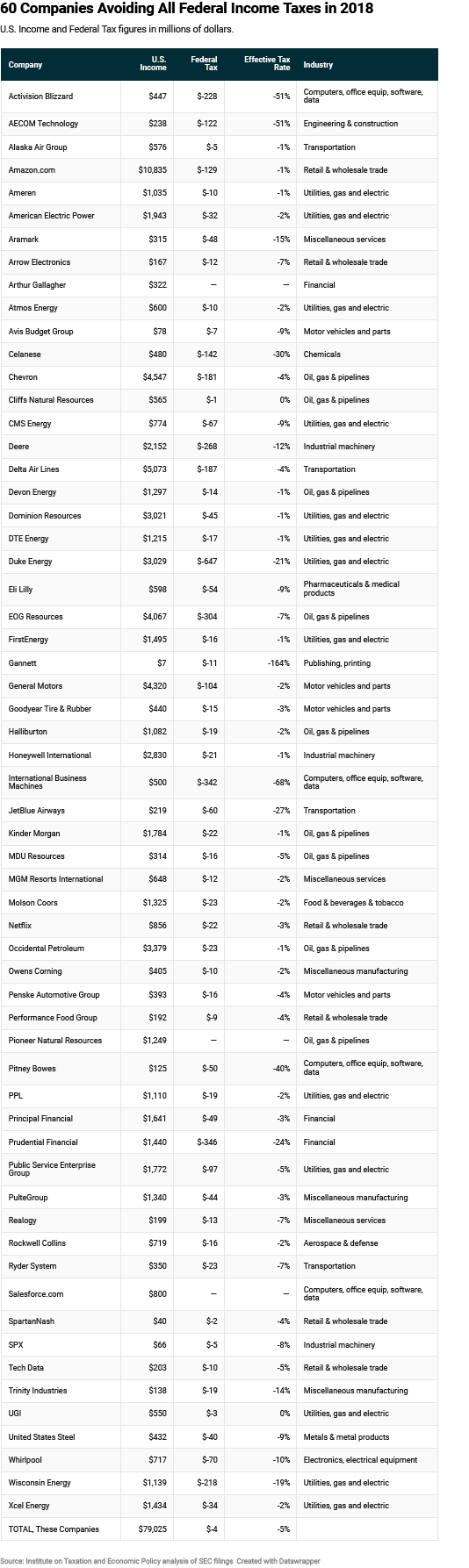

Another day, a new tax code, and big companies still pay no taxes. According to a 2018 report from the Institute on Taxation and Economic Policy, sixty Fortune 500 companies paid $0 in “federal income taxes on $79 billion in domestic pre-tax income. Instead of paying $16.59 billion in taxes as a result of the 21 percent statutory corporate tax rate, these businesses filed a combined net corporate tax refund of $4.3 billion.”[1] These entities employ legions of attorneys and accountants to execute advanced tax strategies. So, how are you, who may not be a billion-dollar conglomerate, able to mitigate your tax liability like a Fortune 500 company?

Another day, a new tax code, and big companies still pay no taxes. According to a 2018 report from the Institute on Taxation and Economic Policy, sixty Fortune 500 companies paid $0 in “federal income taxes on $79 billion in domestic pre-tax income. Instead of paying $16.59 billion in taxes as a result of the 21 percent statutory corporate tax rate, these businesses filed a combined net corporate tax refund of $4.3 billion.”[1] These entities employ legions of attorneys and accountants to execute advanced tax strategies. So, how are you, who may not be a billion-dollar conglomerate, able to mitigate your tax liability like a Fortune 500 company?

The 2017 Tax Cuts and Jobs Act birthed a diverse array of legitimate strategies to zero out corporate federal income tax liability. These tax-advantaged tactics include accelerated depreciation, stock options, and general business tax credits.

In Commissioner v. Idaho Power, the Supreme Court of the United States defined depreciation as the reasonable deduction for the exhaustion, obsolescence, wear, and tear of property used in a trade or business.[2] Depreciation allows taxpayers to expense the cost of any qualified business property (also called qualified use property) and deduct these costs over a period of time determined by the asset class. The Tax Cuts and Jobs Act increased the maximum depreciation deduction from $500,000 to $1 million. Additionally, the new law changed the phase-out threshold from $2 million to $2.5 million. For property acquired after September 27, 2017, and before January 1, 2023, the accelerated depreciation allowance (bonus depreciation rate) increased from 50 percent to 100 percent.[3] Accelerated depreciation allows corporations to deduct the cost of property used in the ordinary course of business more quickly than under traditional straight-line depreciation.[4] As presented by the Institute on Tax and Economic Policy, “Chevron, Delta Airlines, Duke Energy, Halliburton, Dominion Resources, JetBlue, Ryder, Owens Corning, Devon Energy, and Ameren” wrote off depreciation expenses of $8 billion (In 2018, Chevron reported $290 million in depreciation expenses[5] on its Form 10-Q, and Halliburton claimed $320 million using the same deduction).[6]

Secondly, stock-based compensation is an efficient tax savings strategy that is fully deductible and not subject to employment taxes. Anyone who receives property, including employer stock, as compensation must pay income tax on the difference between the value of the stock and the fair market value of their services. In the case of stock-based compensation, the employer may deduct the value of the stock transferred to employees. The employer’s deduction is generally permitted when the stock is included and reported correctly in the employee’s income. Under the Tax Cuts and Jobs Act, employees granted stock options by their employer may defer recognizing income from this grant for five years.[7] On its 2018 Form 10-K, Amazon recorded $1.1 billion of tax benefits from stock-based compensation expenses.[8] In the same way, Salesforce.com and Netflix reduced federal income taxes by $137 million and $191 million, respectively. Even traditional companies “Deere, Rockwell Collins, and Performance Food Group each reduced their income taxes by $20 million using stock options in 2018.”[9]

Next, there are general business tax credits that promote ordinary business activities; such as research and development, utilizing fossil fuels or alternative energy sources, and investing in new equipment. Each of these credits are computed separately and attached to IRS Form 3800. In 2018, Activision Blizzard, John Deere, Rockwell Collins, Netflix, altogether reported $289 million in research and development credits.[10] Occidental Petroleum, Dominion Energy, Duke Energy, DTE Energy, CMS Energy, Xcel Energy, and WEC Energy claimed $632 million in fossil fuel and alternative energy tax credits.[11]

Your potential tax savings are not limited to the credits listed here. Tax strategies often lurk within the ambiguities of the Internal Revenue Code.

Companies disclose the tax credits they claim on their 10-k annual financial filings. However, these documents sometimes fail to clarify which tax breaks were used. For example, Chevron and General Motors together claimed $853 million in “unspecified tax credits” and “general business credits and manufacturing incentives.”[12] You may think that these companies pay no tax because they have hordes of lawyers and accountants working for them, and you are right! You owe it to yourself and your business to enlist the aid of your own tax experts. STA will advise you on how to reduce your tax liability like a Fortune 500 company.

[1] https://itep.org/notadime/.

[2] C. I. R. v. Idaho Power Co., 418 U.S. 1, 10 (1974).

[3] https://www.irs.gov/newsroom/new-rules-and-limitations-for-depreciation-and-expensing-under-the-tax-cuts-and-jobs-act.

[4] https://www.irs.gov/publications/p946#en_US_2018_publink1000107550.

[5] https://chevroncorp.gcs-web.com/static-files/8c2f7eff-7156-440b-8f79-595dad8a162d.

[6] https://itep.org/60-fortune-500-companies-avoided-all-federal-income-tax-in-2018-under-new-tax-law/.

[7] 2017 Tax Legislation: Tax Cuts and Jobs Act: Law, Explanation, and Analysis. (2018). Riverwoods, IL: Wolters Kluwer.

[8] https://ir.aboutamazon.com/node/32656/html.

[9] https://itep.org/notadime/.

[10] Id.

[11] Id.

[12] Id.